What is IDO? A Beginner’s Guide to Initial DEX Offerings in Crypto

Have you ever wondered how new cryptocurrency projects get off the ground? Like, how do they go from an idea in someone’s head to something you can actually invest in?

That’s where IDOs come in. If you’ve heard the term “IDO” floating around but weren’t quite sure what it meant, you’re in the right place.

So, let’s start simple: IDO stands for Initial DEX Offering. It’s a way for blockchain projects to raise money by selling tokens to the public. But wait, what’s with the “DEX” part?

That stands for decentralized exchange.

This means the fundraising happens on platforms like Uniswap, PancakeSwap, or SushiSwap—places where users trade tokens directly with each other without needing a central authority, like a bank or big company, in the middle.

If that sounds a bit complicated, don’t worry.

By the end of this blog, you’ll not only understand what an IDO is but also why it’s such a big deal in the crypto world.

What Is an IDO?

Say a new cryptocurrency project needs funding to get off the ground. They decide to sell their tokens directly to the public on a decentralized exchange (DEX).

That’s an IDO in simple terms.

Here’s why it’s cool:

- It’s decentralized, meaning no middleman like a bank or big corporation.

- Everyone gets a fair shot at buying the tokens.

- It’s fast and often cheaper compared to traditional fundraising methods.

Think of it like Kickstarter for crypto projects but with tokens instead of t-shirts or gadgets.

Why Should You Care About IDOs?

Let me ask you this: do you like being early? IDOs are often where new, innovative projects start. Getting in early means you can snag tokens at a low price before they hit the big leagues.

Here’s an example:

- Uniswap: Early participants in its token sale saw massive returns.

- Axie Infinity: If you joined early, you’d be laughing your way to the bank now.

Of course, not every IDO is a goldmine. But the potential is there, and with the right approach, you can make the most of it.

How to Spot a Good IDO?

Now, here comes the million-dollar question: how do you pick the right IDO? Let me guide you through it:

1. Research the Project

Know what you’re getting into. Ask yourself:

- What problem does this project solve?

- Is there a real demand for its solution?

- Who’s behind the project? (Look for experienced teams.)

For instance, if a project claims to revolutionize DeFi but doesn’t explain how, it might be too good to be true.

2. Check the Community

A strong community is a green flag. Jump on their Telegram, Discord, or Twitter. Are people genuinely excited? Or does it feel like bots are hyping it up?

Real example: Look at projects like Polygon. Their early community played a massive role in their success.

3. Tokenomics

Tokenomics is just a fancy way of saying “how tokens are distributed and used.”

Here’s what to check:

- Total Supply: How many tokens will exist?

- Allocation: Are the founders keeping too much?

- Use Case: What will people do with the tokens?

If you see 50% of tokens going to the team and none to the public, that’s a red flag.

Getting Started with IDOs

Alright, you’ve done your research. Now it’s time to take action. Let me guide you step-by-step:

Step 1: Get a Crypto Wallet

First, you’ll need a wallet. Think of it as your digital purse. Popular options include:

- Metamask (for Ethereum-based tokens)

- Trust Wallet (great for multi-chain support)

Pro Tip: Write down your seed phrase. Don’t lose it. Ever.

Step 2: Choose a DEX Launchpad

A launchpad is where IDOs happen. Some popular ones are:

- Binance Launchpad (centralized but reliable)

- Polkastarter (ideal for Ethereum and Polkadot projects)

- PancakeSwap (for Binance Smart Chain projects)

Each platform has its own rules, so read their guidelines.

Step 3: Get Whitelisted

Many IDOs require you to join a whitelist. This is like reserving your spot.

How to get whitelisted:

- Follow the project’s social media.

- Join their Telegram group.

- Complete tasks like sharing posts or inviting friends.

It’s a bit of effort but totally worth it.

Step 4: Fund Your Wallet

You’ll need crypto to participate, often ETH, BNB, or USDT. Make sure you’ve got enough to cover the tokens and transaction fees.

Example: If the IDO is on Ethereum, you’ll need ETH in your wallet.

Step 5: Participate

On the day of the IDO, log in to the launchpad, connect your wallet, and follow the steps. Be quick; good IDOs sell out fast.

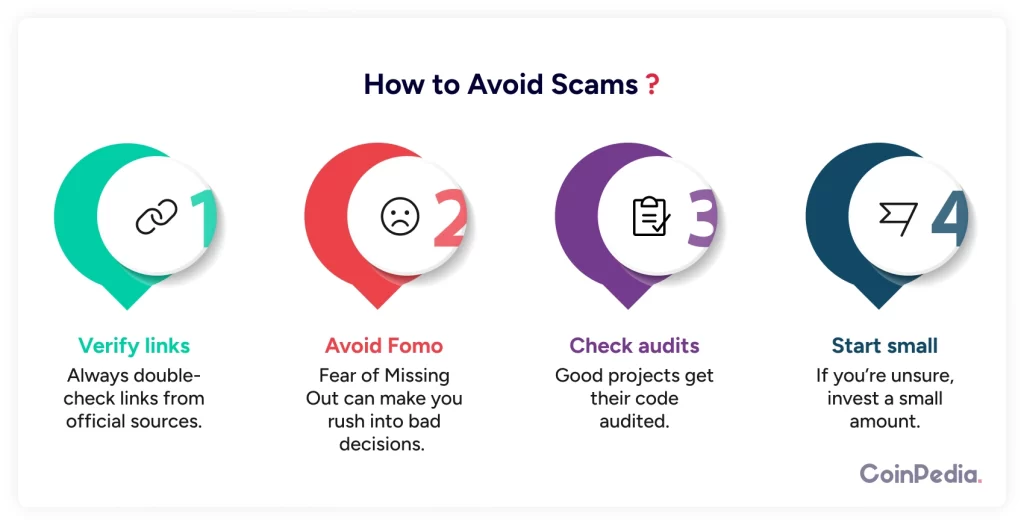

Tips to Avoid Scams

The crypto world can be like the Wild West. Exciting, but full of risks.

Here’s how to stay safe:

1. Verify Links

Scammers love fake websites. Always double-check links from official sources.

2. Avoid FOMO

Fear of Missing Out can make you rush into bad decisions. If something feels off, trust your gut.

3. Check Audits

Good projects get their code audited. If they don’t mention an audit, ask why.

4. Start Small

If you’re unsure, invest a small amount. You can always increase later.

Real Talk: The Risks

Let’s be honest. Not every IDO will make you rich. Some might flop. Here are the risks you need to know:

- Market Volatility: Prices can swing wildly.

- Rug Pulls: This is when developers vanish with your money. Ouch.

- Technical Issues: Sometimes launchpads crash during high demand.

The key? Diversify. Don’t put all your eggs in one basket.

So, what next?

See? IDOs aren’t rocket science. With the right approach, they’re a fantastic way to explore new crypto projects and potentially make good returns.

Just remember:

- Do your research.

- Stay cautious.

- Start small and build confidence.

By now, you’ve got everything you need to get started. So, what are you waiting for? Go out there and give it a shot. Who knows? The next big crypto project might just be waiting for you to discover it.