Bitcoin ‘OG’ Wallets are Back on the Move—Will This Push the BTC Price to $110K?

Soon after the latest pullback, the Bitcoin price has been tightly consolidating within a range after facing rejection from the highs. However, the pullback appears to be yet another higher low, which keeps up the possibility of a breakout. In the past few days, institutions have been aggressively accumulating Bitcoin, while others have been raising funds to buy more, such as Statergy. With the bullish momentum refueling, the Bitcoin cohorts have again become active.

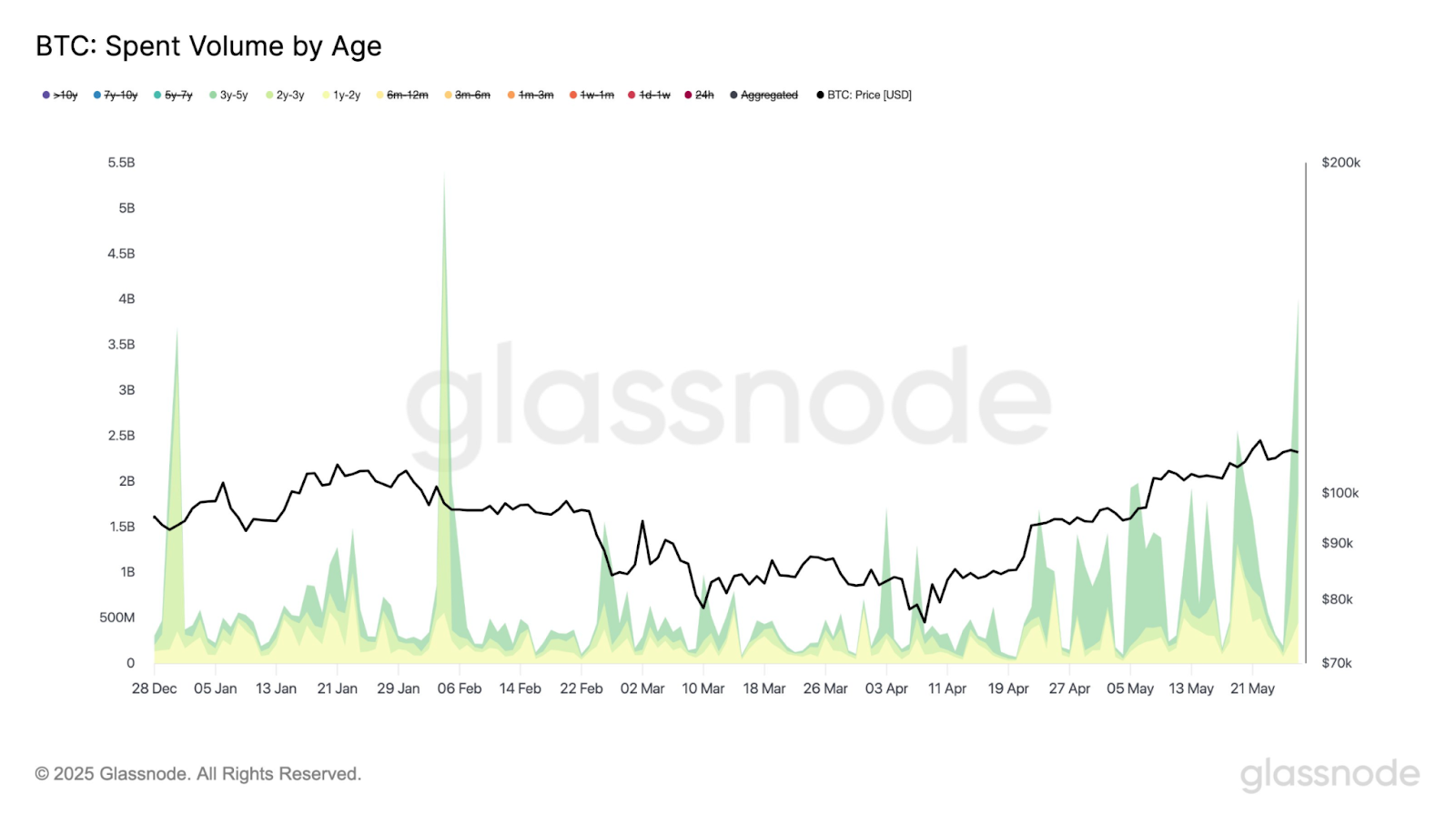

The Bitcoin cohorts refer to groups within the network that are used to understand the trend patterns and economic behaviors related to BTC transactions. Woefully, the spending by the older BTC holders has hit a high. The Aggregate volume of 1-year to 5-year cohorts has surged above $4 billion, suggesting the older coins are on the move.

The rise has been seen for the first time since February 2025, while the 3-year to 5-year cohort contributed $2.16 billion out of $4 billion, which is their second-largest outflow. While 2-3 cohorts and 1-2 years contribute $1.41 billion and $450 million, respectively. In recent times, the change in their positions has always triggered interim BTC peaks, be it in Q4 2024 or in February or May 2025. Now the question arises whether this is a bearish signal for Bitcoin.

Seeing 1y to 5y BTC moving isn’t a red flag yet, as most of this appears to be institutional accumulation, but not actual dumping. The exchange netflows are negative, while ETF inflows sharply rise, indicating they could be buying. However, if these tokens hit the exchanges, one can expect a sharp move. Hence, the Bitcoin (BTC) price movement is required to be closely monitored for the next few days.