Litecoin Price Eyes Breakout – Will $110 Trigger a Fresh Rally?

Litecoin price is showing signs of renewed bullish momentum as it kickstarts August with a modest yet significant recovery. Coming to numbers, in the last 24 hours, the LTC price has gained 1.79%, now trading at $107.77. With this, the market cap has edged up to $8.14 billion.

Successively, a bounce from its 24-hour low of $103.75, coupled with a 16.19% rise in trading volume, suggests buyer confidence. With multiple bullish catalysts aligning, Litecoin could be on the verge of breaking out from weeks of sideways action. Intrigued by the numbers? There could be more in store for LTC. Read this price analysis for all details.

Active Addresses to Hit ATH?

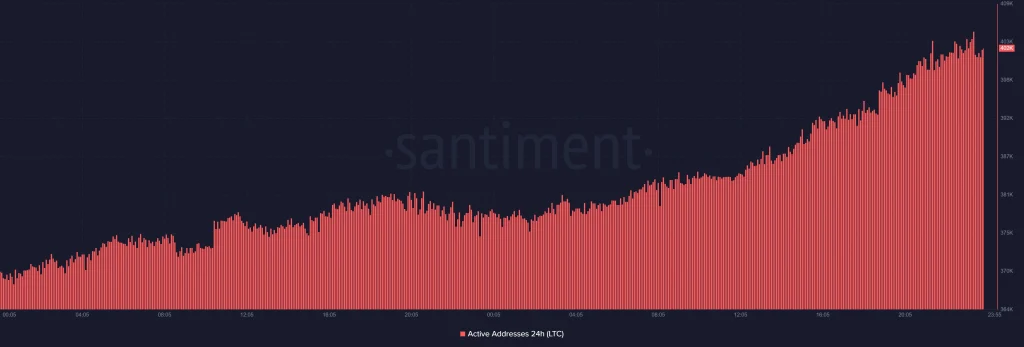

On-chain fundamentals also paint a supportive picture. As evident from Santiment’s chart, Litecoin’s 24-hour active addresses have surged past 402k, reflecting sustained user growth. This steady rise in unique daily activity suggests real-world adoption is rising at the same pace as speculation among traders.

It is widely known that a spike in active wallets often comes before durable rallies, reinforcing the strength of current bullish signals. The consistent uptick throughout the week indicates network participation remains high, even during recent pullbacks. Further justifying credibility to the ongoing recovery.

LTC Price Analysis:

Litecoin price is currently hovering just above the $107.20 pivot. A clean move past this level opens the doors to the $108.80–$110.70 resistance band. Traders need to note that this is a region where sellers have historically stepped in. The 4-hour chart I’ve shared reveals strengthening momentum, with the RSI at 45.90 steadily climbing after bouncing from oversold territory.

Successively, the price candles are beginning to press against the midline of the Bollinger Bands. More significantly, a golden cross had emerged on the higher timeframes, with the 50-day EMA at $103.7 now above the 200-day EMA at $92.91. Coming to targets, the LTC price could retest the $121.90–$122.20 range in the short to mid-term. This would be once the $110 hurdle is cleared.